When you apply for a loan, lenders zoom in on your credit history. A high FICO score conveys reliability. Sadly, reports from the biggest agencies like Equifax may be flawed. False negatives like overdue payments result in lower scores and a wrong impression. Across the US, loan applications are rejected due to errors. Companies like Credit Saint promise to right the wrongs tarnishing your reports.

Few people have the patience and expertise to solve this problem on their own. You need to communicate with banks and bureaus, collect evidence and navigate the laws. As a credit repair company, Credit Saint has a full package of services. It gathers your reports from major bureaus, finds inaccuracies, and disputes them. This does not happen overnight, and you are charged monthly.

Score fixing is a big industry, but there are no guaranteed results. Still, Credit Saint boasts an unbeatable money-back policy. If all errors stay intact, you get a refund. This is a major selling point, but not a deciding factor. In this Credit Saint review, we look at the company’s services, rates, and reputation to draw an objective conclusion. Can you count on the firm, and does it deliver good value for money?

What Is Credit Saint?

Since 2004, this business has been helping Americans enhance their FICO scores. The Credit Saint mailing address and headquarters are in Oakland, New Jersey. The firm received BBB accreditation in 2007, and its rating remained stellar (A+) for over a decade. Now, it has been lowered to A. This is still a decent total, as many competitors are not accredited at all.

The firm’s mission is to help you restore the FICO score through the eradication of report errors. False information, such as tax liens, late payments, and repossessions, drag down the total. As a result, lenders reject your applications or demand outrageous interest.

Companies like Credit Saint are popular because fixing the score by oneself is a challenge. Delegate the job to professionals, sit back and track their progress. Cancel the service at any time.

There is no shortage of reviews for Credit Saint. Unlike competitors, it allows you to sign up online. For many customers, this enrollment method is the most convenient. The first consultation is also free, but the biggest strength is an impressive reimbursement guarantee. It covers the first 90 days. If your score remains unchanged, you get a refund — no questions asked. Learn more about Credit Saint prices, service bundles, and transparency below.

Pros and Cons of Credit Saint

According to most Credit Saint credit repair reviews, the benefits are more pronounced. First, the BBB rating has been fairly consistent since 2007. The company offers three service grades, from basic to aggressive. If there are just a few mistakes, you can pick the most affordable package. Other advantages are:

- Credit Saint money-back guarantee;

- effortless cancellation.

Unless the firm eliminates at least one entry by the 91st day, you may request a refund. Few rivals extend their guarantee that far — some offer no refunds at all! This policy is often praised in Credit Saint testimonials. As the company works in 45-day cycles, it must show results before the second one is over. Otherwise, the customer gets their money back — no questions asked.

The staff is polite and responsive, which is reflected in customer feedback across platforms. Communication is provided via Credit Saint phone number, email, and online chat. Customers are also informed about the progress every month via a phone call. Cancellation is possible at any time and without extra fees. Credit Saint prides itself on its service standards.

Still, there are downsides. While the monthly Credit Saint cost is competitive, the setup fees are still high. The cheapest option overall is the Polish Plan, but its features are limited (just 5 disputes per month). The services are inaccessible in some states. At the moment, residents of South Carolina, Kansas, and Georgia may not enroll. Finally, the Credit Saint BBB rating does not factor in customer sentiment.

How Does Credit Saint Work?

Begin by scheduling your first consultation. The company provides it free of charge. Its representatives scrutinize your reports line by line to spot inconsistencies. Then they suggest the best strategy — your customized plan for score improvement.

If you decide to enroll, the firm will first verify your identity. You are asked to take a picture of your credit card and send it by email. Once the check is complete, you may log in to your account page on the site. Choose from three Credit Saint programs and make the first payment. Now, the experts will start working on your score.

Delegate the job to pros and monitor their progress online! The company will work in 45-day cycles. It will send formal letters to bureaus and lenders to collect evidence and have the inaccuracies removed. Gradually, your FICO score will improve.

On average, you need at least two cycles to achieve the goal. Please note that the company will only delete entries that are false. Check the BBB site for ‘before and after’ Credit Saint reviews.

Here is an example. Suppose you choose the Remodel Plan. Over the first 90 days, it will cost you roughly $400 in total. If the company raises your FICO score by 50 points, you may save much more — thousands of dollars — on your next loan, as the interest rate will be much lower. As you can see, the long-term benefits are undeniable.

Credit Saint Prices

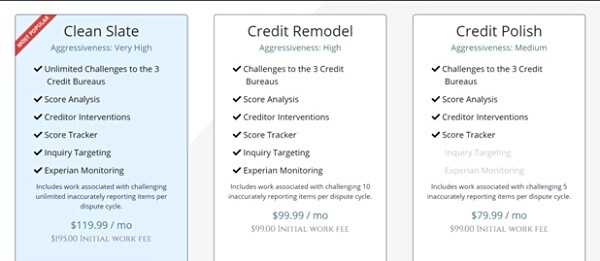

So, how much is Credit Saint per month? The company has split its services into 3 bundles, from basic to advanced. The range suits the needs of all customers. Whether you have a few entries to delete or a complicated case, Credit Saint has a package for you. In this regard, its tiered pricing is similar to competitors. Here is how the three levels compare.

Credit Polish is the most basic option with limited consultation and representation. The cost comprises the monthly fee ($79.99) and the setup fee (aka first work fee) of $99. This gives you:

- preliminary score analysis (on the site);

- 5 disputes of false entries monthly (except for hard inquiries, i.e., your applications for loans or credit cards);

- an online progress tracking tool (on the site).

Credit Remodel is the intermediate option. The setup fee is the same ($99), but the monthly fee is higher ($99.99). In addition to all the basic services, you get 10 inquiries instead of 5, and a personal representative is assigned. Experian monitoring is also included.

The most expensive bundle is Clean Slate ($119.99 monthly + $195 upfront). Many Credit Saint reviews describe the price as exceptionally high. This is the only package with unlimited disputes.

In addition, the firm will send cease and desist letters, so collection agencies and lenders stop bothering you with unpleasant phone calls. As the number of inquiries is not limited, the repair process is the quickest with Clean Slate.

Alternatives to Credit Saint

Naturally, there are many more companies on the market. Discover four top contenders below. The firm has many strengths, but the upfront Credit Saint fees are hardly competitive.

Lexington Law

While this company is one of the oldest, its reputation is now shaky due to negative reviews and legal action. Unlike Credit Saint, it does not offer refunds. When comparing Credit Saint vs Lexington Law, you will also see that the rival’s monthly cost is higher.

Ovation Credit Services

This rival is one of LendingTree’s affiliates, so it is not privately owned. The monthly rates are almost identical. Credit Saint charges more upfront, but the competitor does not provide tracking in all packages. Still, it has a higher rating with Better Business Bureau than Credit Saint.

CreditRepair.com

This company has a few strengths, but consistently negative feedback is a red flag. The upfront fees are also relatively high. The app and educational library cannot outweigh the absence of a refund guarantee.

Sky Blue

The biggest drawback is the paid introductory consultation. The rival does not offer progress monitoring. On the upside, its fees are average, there is just one universal service bundle, and refunds are provided unconditionally.

| Credit Saint | Lexington Law | Ovation Credit Services | CreditRepair.com | Sky Blue | |

| In business since | 2004 | 2003 | 1976 | 2012 | 1989 |

| Services | repair, tracking | repair, tracking, identity theft protection | repair, tracking | repair, tracking, education | repair |

| Cost (monthly) | $79.99-$119.99 | $89.95 — $129.95 | $79 — $109 | $69.95 — $119.95 | $79 |

| Upfront fee | $99-$195 | – | $89 | $69.95 — $119.95 | $79 |

| Customer service | portal, email, phone, Credit Saint chat | app, email, phone | website, email, phone | app, email, phone | portal, email, phone |

FAQ

Like any company in this industry, Credit Saint has its pros and cons. In this section, we have answered the most common questions from consumers. These concern the Credit Saint customer service, reputation, and reimbursement guarantee.

Conclusion

So, is Credit Saint best for overall results? It is a strong provider with a high BBB rating, flexible services, and excellent support. However, the high setup fees are a major deterrent for many customers. Limits on disputes are only lifted in the most expensive bundle. At the moment, pricing is the key weakness, but the money-back guarantee is exceptional. Nevertheless, this is one of the best credit repair companies, as our comprehensive guide shows.