Poor FICO scores have far-reaching implications. Loans are inaccessible as lenders consider you a risky borrower. If new applications are approved, the interest is much higher than you hoped for. For banks, high scores are proof of reliability. Negative entries on credit reports like repossessions or late payments drag them down. When this information is false, a credit repair company like Lexington Law can help you.

Few consumers have enough patience and expertise to fix their own scores. It is feasible but daunting. To succeed, you need to gather evidence and dispute the mistakes with creditors and bureaus in writing. Requests for additional proof result in prolonged back and forth. A complex repair could take up to a year! Lexington Law has a team of paralegals who know how to accelerate the process.

The company will scrutinize your reports, find the errors, collect evidence and send dispute letters on your behalf. It is one of the oldest and best-known providers in the industry. In this Lexington Law review, we have analyzed the firm’s services, prices, and reputation to reach a verdict. Can you count on this provider?

What is Lexington Law?

The purpose of credit repair is to raise FICO scores through the correction of reports. By disputing wrong items, the Lexington Law firm can have them removed. This is a lengthy and complex procedure, which is why many consumers delegate it to professionals. According to the website, the company has a team of lawyers with John C. Heath as the Directing Attorney. It was established in 2004 and has deleted over 56 million false entries since then.

Today, this Utah-based fixer is one of the biggest names in the industry, as it serves customers in 48 states. It offers three bundles of services to meet a broad spectrum of needs. Lexington Law’s app is one of the most powerful in the industry. It has high ratings in both App Store and Google Play.

The packages cover repair, financial planning, and protection against identity theft. Undeniably, this is not the cheapest provider as its rates start from $89.95. On the upside, even the basic package is quite comprehensive.

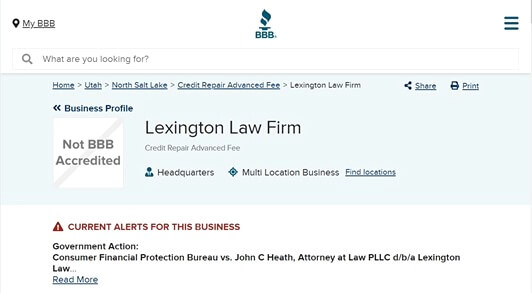

In recent years, the firm’s reputation has deteriorated. It has faced criticism from customers and has even been sued. The Lexington Law BBB rating is a C, and customers are alerted to pending government action (Consumer Financial Protection Bureau vs. John C. Heath). This should make you wonder if the firm is reliable. We have weighed up the pros and cons below.

Pros and Cons of Lexington Law

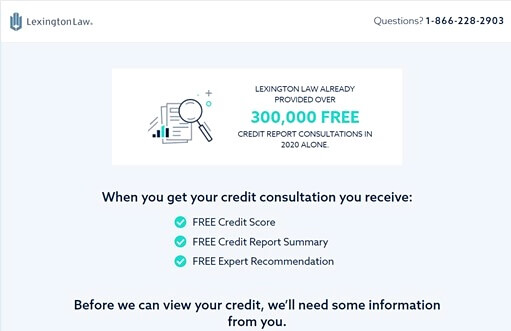

First, the company’s mobile app is something to be proud of. It gets stellar reviews from users as can be seen in both app stores. Secondly, every new customer gets their first consultation free of charge. The staff checks their FICO score, produces a summary of the reports, and recommends the best strategy to deal with the errors.

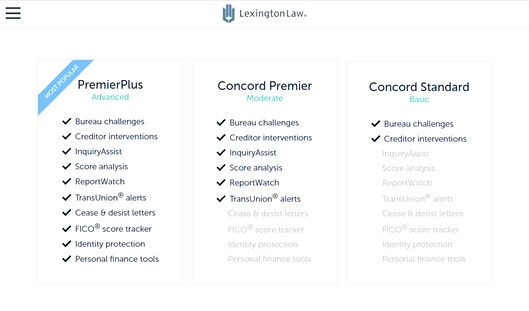

The range of Lexington Law plans includes basic, intermediate, and advanced options. It is a common range of packages. You can choose the most suitable bundle based on the complexity of your case. Two packages include free monitoring of the FICO score.

By law, no company may charge you before any services have been rendered. Some rivals circumvent these regulations by requiring a ‘setup fee’ or a ‘first work fee’ comparable to the monthly charge. Lexington Law does not require any upfront payments, which is a major advantage.

On the downside, the prices are relatively high. The monthly cost is hardly competitive, and the firm does not offer any refunds. Its services are also inaccessible in two states: Oregon and North Carolina.

An even bigger concern is complaints. As of this writing, the BBB site shows 664 negative Lexington Law reviews over the past 3 years. It is overwhelming, and the average customer review rating is merely 2.11/5. In addition, 7 complaints have been filed with CFPB that sued the firm for deceptive telemarketing practices and illegal charges in 2019. This makes many people wonder: does Lexington Law really work?

How Does Lexington Law Work?

The firm follows the standard repair procedure. It collects your reports, analyzes them, finds inaccuracies, and disputes them by means of formal letters. Depending on the complexity of your case (i.e., the number and nature of the errors) you may pick a suitable service bundle from three options, from basic to aggressive. The firm does not offer debt consolidation, but it can help you arrange it.

As the initial consultation is free, the company will help you make the right choice. Its employee will explain the range of services on each level, give an overview of your case and suggest the best package. Once you sign up, the team gets down to work. Within 48 hours, you get a call from your personal representative.

The experts collect your reports from three major agencies in the US (Experian, TransUnion, and Equifax). It is essential as any lender may share data with only one bureau. Then, the documents are meticulously analyzed to pinpoint any errors. For example, you may need to remove evictions that aren’t true. The company will collect evidence to support its dispute requests.

Next, the firm liaises with creditors and sends customized dispute letters to the bureaus. The agencies consider the provided evidence and clean your reports. As negatives like late payments and charge-offs vanish, your credit score rises automatically. If any issues remain unresolved, they will still be followed and escalated.

Lexington Law Prices

Every credit repair case is unique. Some customers have a few errors to erase, so core services suffice. Others may have complicated cases involving all three bureaus and dozens of mistakes. Lexington Law offers three tiers to suit everyone’s needs. It can remove judgments, tax liens, late payments, and other entries. Here is how the options compare.

Basic: Concord Standard ($89.85/month)

This bundle contains all the essentials of repair. Both disputes and interventions are included. First, the firm will find the errors and request removal from the bureaus. At the same time, it may send different letters (i.e., goodwill and/or debt validation letters) to lenders and collection agencies. Compared to other entry-level packages, it is worth the money.

Intermediate: Concord Premier ($109.95/month)

This bundle includes several useful extras. First, false hard inquiries may also be disputed. These entries reflect applications for loans or lines of credit. In addition, every customer receives an analysis of their FICO score and tracking tools. They are notified of any changes to their total.

Aggressive: PremierPlus ($129.95/month)

It is the only package with cease and desist letters. They are sent to lenders and collection agencies to make them stop bothering you. The measure stops intrusive phone calls.

The firm will also provide identity theft protection. Other extras are accessible through the proprietary app. These are tools for financial planning and a FICO® score tracker.

Alternatives to Lexington Law

We have compared the company’s conditions to other offers on the market. Here is how the firm stacks up against the four strongest competitors. As you can see from the chart, the Lexington Law prices are the highest.

Sky Blue

This company’s rates are among the lowest in the industry. There is just one package of services, but no monitoring is offered. Unlike Lexington Law, the company does not provide free consultations. Still, its refund policy is unbeatable (unconditional money-back guarantee).

CreditRepair.com

The youngest company on our list, CreditRepair.com, Inc. offers no refunds. Consistently negative feedback is a red flag, although the number of complaints on the BBB site is lower (74 in the past 3 years). Unlike Lexington Law, the firm charges high fees upfront.

Credit Saint

This company has some of the highest setup fees in the industry. Disputes are limited unless you get the premium package. On the upside, you can sign up online, and the money-back policy covers 90 days.

Ovation

The key advantages of Ovation are its BBB accreditation (A+) and reputation. Every package includes assistance from a personal advisor, and the fees are average. However, like Lexington Law, the firm gives no refunds.

| Lexington Law | Sky Blue | CreditRepair.com | Credit Saint | Ovation Credit Services | |

| Year of establishment | 2004 | 1989 | 2012 | 2004 | 1976 (2004) |

| Services | repair, tracking, financial planning, identity theft protection | repair | repair, tracking, education | repair, tracking | repair, tracking, education |

| Monthly cost | $89.95-$129.95 | $79 | $69.95 — $119.95 | $79.99-$119.99 | $79-$109 |

| Upfront fee | none | $79 | $69.95 — $119.95 | $99-$195 | $89 |

| Support | phone, email, app | phone, email, portal | phone, email, app | phone, email, chat, portal | phone, email, website |

FAQ

Lexington Law is a well-known provider. Still, like other repair companies, it gives no guarantees. Here are some of the most common questions. Discover what customer service is like, how payments are processed, and if you can get a refund.

Conclusion

Lexington Law is a well-established provider of repair services. However, its reputation is not immaculate. Consistent criticism and pending legal action should make you think twice before using its services, as no refunds are provided. Check our overview of the best credit repair companies to find the best alternatives.