Lenders are interested in responsible borrowers, and they always consider your FICO score. Across the US, applicants are rejected due to poor totals — sometimes, unfairly. Even if you invariably pay on time, your credit reports may be less than perfect. Sadly, mistakes happen, and erasing them is a hassle. Companies like Ovation Credit Services offer to have false negatives removed on your behalf.

For the average consumer, correcting the score is a challenge. The legal landscape and intricacies of formal communication make it insurmountable. This explains why credit repair is such a big industry: the demand for representation is high. Ovation Credit will liaise with banks, bureaus, and collection agencies on your behalf or guide you through the process. With its upgraded package, you can just sit back and monitor the correction.

Eventually, false information like charge-off, tax liens, and bankruptcy entries disappears. The score improves immediately, so you get access to cheaper borrowing. But how does this company stack up against its competitors? We have analyzed its reputation, services, prices, and customer feedback to identify the pros and cons. Based on the latest Ovation Credit reviews, here are the key things to know in 2021.

What is Ovation Credit?

This Florida-based firm was incorporated in 2004, but its history dates back to 1976. The LendingTree affiliate is headquartered in Jacksonville. The parent company provides a broad spectrum of services, including personal loans, mortgages, and debt consolidation. Like Ovation, it is accredited by the Better Business Bureau with a stellar rating of A+.

Ovation Credit is focused on the repair of FICO scores. It collects and analyzes reports to find and dispute errors. However, its services are far from ordinary. First, there are just two packages, and only one of them includes representation. The basic plan provides guidance from a professional analyst. The advanced bundle offers unlimited disputes on your behalf. Besides, the company has a convenient standalone tracking service.

All in all, it pays more attention to education than most competitors. Usually, a repair firm offers to handle all the analysis and disputing work for you. Ovation also educates customers on the proper procedures. This knowledge helps them in the future. If new mistakes appear, they may be able to fix them without assistance. Learn about the key strengths and weaknesses of the firm from our Ovation Credit Services review.

Pros vs. Cons of Ovation Credit Repair Services

The absence of a money-back guarantee is a deterrent for many consumers. At the same time, there are quite a few advantages service-wise. First, members receive personalized attention, as a dedicated advisor is assigned to every case. It is not limited to advanced packages.

Secondly, all subscribers have access to digital tools for financial planning. They are designed to boost financial literacy and help rebuild their credit. The proprietary solutions have budgeting and debt management features.

Finally, consider the Ovation Credit discount system. Senior citizens, army personnel, referrals, and couples may save as much as 20%. Besides, anyone can use the company’s credit monitoring service. Non-customers may purchase the subscription separately. When members decide to cancel, they can do so without advance notice.

The biggest drawback is the absence of refunds. If a customer is dissatisfied with the service, they cannot get any reimbursement. Additionally, non-premium users have limited disputes and tracking. To access the entire spectrum, you need the Essentials Plus Plan. Finally, the company has no mobile app, and you cannot chat with the staff online. You would expect more from an affiliate of LendingTree.

How Does Ovation Credit Work?

You are assigned a personal care advisor. Initially, they obtain copies of your reports from Experian, TransUnion, and Equifax. After careful analysis, the employee identifies false negatives. Duplicate entries, inaccuracies, and unverifiable debts may all be disputed. What happens next depends on the package — the basic one gives guidance but no actions on your behalf.

Premium customers may delegate all the tasks to the firm. The legal team will liaise with lenders and bureaus to have the mistakes removed. This is done through:

- goodwill letters;

- dispute letters;

- debt validation letters.

On average, your score should start improving in 30-45 days. Ovation will also help you create a credit optimization plan, so you will make wiser decisions in the future. If you are planning to take out a mortgage or business loan, the company’s guidance will help you get better conditions from the lender. Ovation helps customers rethink their habits and borrow responsibly. When the score is beyond repair, this is the only way to rebuild it.

After your FICO total is fixed, you may still track it through Ovation’s separate service. This way, you can spot errors or fraud before serious damage is done. This requires a separate subscription, and you do not have to be a member to use it.

Ovation Credit Prices

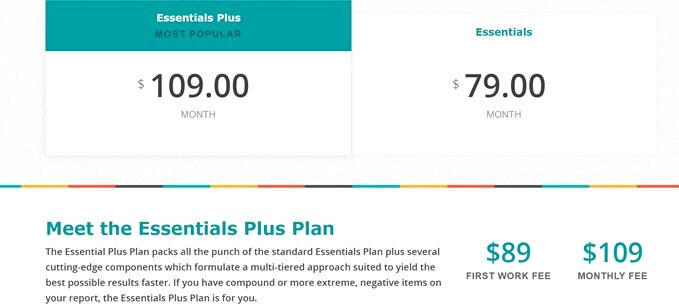

The firm offers 2 grades of service (most rivals have 3) with the same upfront fee of $89. There is no intermediate option — you take either the basic or the advanced package. Both include the services of a personal care advisor, which is another benefit. However, the depth of their involvement varies. Here is an overview of the Ovation Credit prices.

Essentials Plan

For $79 a month, you get an advisor’s assistance, but their role is mostly educational. Do not expect the employee to send any letters on your behalf. Instead, they will guide you through the procedures so you can file the disputes yourself. You will get hands-on experience communicating with major bureaus. You may also use a set of financial tools on the company’s portal.

Essentials Plus Plan

The advanced plan will set you back $109 monthly. Aside from the core services, you get TransUnion tracking and extras that accelerate the process. The firm will send customized letters on your behalf (in unlimited numbers). It will also provide a recommendation letter to submit with future loan applications.

The focus on education and hands-on repair is unparalleled. Most fixing firms offer to do everything for you, from analysis to disputes. Ovation aims to raise financial literacy and help customers navigate the complexities of repair. As a result, if any mistakes appear on your reports in the future, you will be prepared to disprove them yourself. The company’s digital tools develop debt management skills, so users learn to plan their borrowing.

Alternatives to Ovation Credit Repair

We have compared Ovation Credit Services fees and conditions to the strongest rivals. Reputation and a high BBB rating are some of their biggest strengths. Today, many companies offer a money-back guarantee — sometimes, even unconditional. Ovation provides no reimbursement, but it has other benefits, such as help from a personal advisor.

Lexington Law

It is one of the best-known providers. However, it has recently faced legal action. The BBB site has registered 662 complaints over the past 3 years. The prices are also quite high, although no upfront fee is charged. As Ovation, the company does not offer refunds.

Credit Saint

Credit Saint is the only firm that allows online enrollment. The 90-day money-back policy is another advantage over Ovation. However, the upfront fees are very high, and disputes are unlimited only with the most expensive package.

Sky Blue

Unlike Ovation, this firm does not provide monitoring or a free initial consultation. Still, it has an unconditional money-back policy, which is rare. All the services are packed into a single bundle. Pricing is another advantage, as it is very competitive.

| Ovation Credit Services | Lexington Law | Credit Saint | Sky Blue | |

| Established in | 1976 (2004) | 2004 | 2004 | 1989 |

| Services | Repair, tracking, education | Repair, tracking, planning, identity theft protection | Repair, tracking | repair |

| First work fee | $89 | none | $99-$195 | $79 |

| Monthly cost | $79-$109 | $89.95-$129.95 | $79.99-$119.99 | $79 |

| Customer support | Phone, email, website | Phone, email, app | Phone, email, chat, web portal | Phone, email, web portal |

FAQ

Sadly, the repair industry is laden with fraud, so customers should be cautious. Ovation Credit is a legit company, and it may be counted on. Here are the most common questions about its services.

Conclusion

Unlike most competitors, Ovation Credit Services has a strong focus on education. Its customers may choose between guidance and full representation. Based on the excellent BBB rating and positive customer reviews, it is one of the most attractive providers in 2021.

Ovation keeps most customers happy despite the absence of a money-back guarantee. Its position is particularly strong in comparison with Lexington Law, which is now mired in legal woes. As a result, we include Ovation in our list of the best credit repair companies.