When you apply for a loan or credit card, the lender always looks at your FICO score. When it falls below 700, borrowing becomes difficult. Your applications are rejected, or the interest rate is too high. Sometimes, the total is dragged down by mistakes on credit reports. In this case, it may be restored. The Credit People offers to arrange this for you.

As a consumer, you could collect and analyze your own reports without a credit repair company. However, disputing the errors is not always feasible. First, you should understand the subtleties of laws and formal communication. You need to write specific letters to banks and bureaus. If they request an additional proof, the process takes many months. A team of professionals will accelerate it.

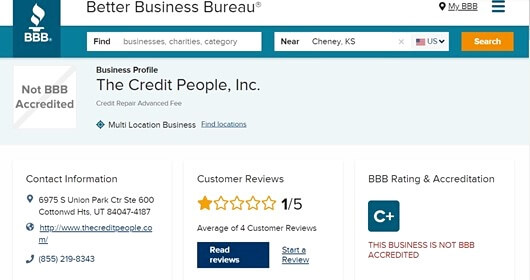

How does the company stack up against the competition? For this review of The Credit People, we have analyzed the company’s services, prices, reputation, and support. Our verdict is based on the pros and cons deduced from the official website, BBB ratings, and other reliable sources. It shows why the company is among the providers of the best credit repair services.

What Is The Credit People?

Like other companies in the industry, The Credit People promises to raise your FICO score. The staff collect reports from all three major bureaus (Equifax, Experian, and TransUnion), scrutinize them, and dispute inaccuracies. Outdated items and false entries are removed.

The Credit People is headquartered in Cottonwood Heights, Utah, and has branches in Florida and Chicago.

The firm has been in business since 2001, which makes it one of the oldest providers. Over the past two decades, it has served over 100,000 clients across the country. It mainly communicates with customers by phone and email and allows online enrollment. While the team is cleaning your records, you may track their progress via the web portal. Pricing is one of the biggest advantages — the setup fee of $19 is the lowest you can find!

Unlike competitors, the Credit People does not divide its services between bundles. There is just one comprehensive package for repair and monitoring. According to the official website, the firm has been mentioned in The Wall Street Journal, Smart Money, and USA Today. But why should you choose The Credit People for legal credit repair?

Pros vs. Cons of The Credit People

Currently, the company’s pricing, particularly the setup fee, is unmatched. Customers pay only $19 upfront (some rivals charge over $100), and the monthly rate is merely $79, which is average for the industry. Customers may cancel at any time and get their last month’s payment back (the money-back policy covers 60 days or 6 months, depending on the payment system).

Secondly, there is just one service bundle, and disputes are unlimited. The Credit People does not charge an extra fee for monitoring, and it has plenty of educational resources. The website offers a free PDF guide and a video guide describing the company’s services. There are also dozens of articles and videos in the Help Zone, all free.

Unfortunately, the company does not have a mobile app, and there is no Live Chat either. It does not offer a credit line, so you may only repair the score, not rebuild it. If the negative entries on your report are correct, the firm is powerless — you may only use its guidance to improve your borrowing strategy.

The site emphasizes the savings you can make with a flat-fee plan, but its duration (6 months) may be too long for simple repair cases. Finally, as the firm was only incorporated in 2016, The Credit People reviews are very limited. It is hard to assess the real customer experience.

How Does The Credit People Work?

First, the staff will obtain your reports from three bureaus and analyze them. They will identify negative items that are incorrect or outdated. The range of questionable charges includes dubious charge-offs, payments inaccurately marked as late, duplicate entries, etc. Then, the firm will start collecting evidence to submit to the credit agencies. It will send formal letters to lenders and bureaus to have the items removed.

As a rule, the process takes a few months. The more mistakes there are — the longer. You may pay monthly or buy a six-month package to get a discount. While you could analyze your reports and dispute the mistakes yourself, the company achieves the result faster. These professionals negotiate with banks and bureaus daily.

At the same time, the company may also help you to plan future borrowing wisely. It will create a personalized plan to work on any weaknesses hurting your score. Repair is just the first part of the equation. If the credit records are tarnished by your own failures, the improvement of your budgeting skills is crucial.

On average, you may expect to see a 30% rise in credit score within the first 60-75 days. If you are not satisfied with the services (for any reason!), you are protected by the money-back guarantee. The firm will give a refund unconditionally.

The Credit People Pricing

You will not find different tiers of The Credit People plans. All services are neatly packed into a single universal bundle. The pricing is extremely competitive — you can hardly find a price lower than this (a setup fee of only $19 and a monthly charge of $79). Customers may also save $74 by choosing the 6-month prepayment scheme. In this case, repair costs $419 in total. The complete package includes the following services.

First, the company identifies errors it can dispute. The team collects evidence and sends customized letters to credit bureaus. These services are at the core of credit repair. By law, credit bureaus have to respond to any dispute letter in 30 days.

A part of evidence collection is debt validation. The firm sends letters to your creditors asking them to prove that the debt exists and to confirm the amount. Unlike most rivals, The Credit People can check hard inquiries. These entries are created whenever you apply for a loan or a credit line. Few repair firms render this service.

All active members have easy access to tracking features. The company keeps them informed of any changes to their reports. Real-time updates are included by default. It is another substantial benefit of score enhancement through The Credit People.

Alternatives to The Credit People

Despite its controversial customer ratings, The Credit People has quite a few advantages. First, it offers a single comprehensive package at an attractive price. Secondly, it has an unconditional money-back guarantee. Comparison to other well-established firms confirms the company’s strengths.

Lexington Law

One of the best-known firms is now facing legal action and consistent criticism from customers. Despite the absence of upfront fees, the monthly cost is considerable. There are three levels of services and a powerful app, but no money-back guarantee. The feedback is much worse than The Credit People client reviews.

Credit Saint

This company charges high upfront fees, but the scope of services hardly justifies the pricing. You need to pay for the premium package to access unlimited disputes. Like The Credit People, the firm allows you to sign up online, and it offers a money-back guarantee (90 days).

Sky Blue

This company’s refund guarantee is the most attractive in the industry. It is unconditional and covers 90 days. Like The Credit People, the firm packs all services into a single bundle. On the downside, it does not offer any monitoring tools.

| The Credit People | Lexington Law | Credit Saint | Sky Blue | |

| Founded in | 2001 (2016) | 2004 | 2004 | 1989 |

| Services | repair, monitoring | Repair, tracking, financial planning, identity theft protection | repair, tracking | repair |

| Monthly cost | $79 | $89.95-$129.95 | $79.99-$119.99 | $79 |

| Upfront fee | $19 | none | $99-$195 | $79 |

| Support | phone, email, portal | phone, email, app | phone, email, chat, portal | phone, email, portal |

FAQ

The Credit People has been in business for two decades, but limited BBB reviews make customers hesitant. Can you really trust this company? Does it provide good support and guarantees? Here are the most common queries.

Conclusion

Despite the lack of feedback, we have identified essential strengths that set The Credit People apart. It offers a comprehensive package for a highly competitive price. The monthly rate is the best in the industry, customer service is responsive, and the money-back guarantee may cover 6 months of service!