Your FICO score should reflect your reputation as a borrower. Lenders use it as a shortcut to weed out risky applicants. Sadly, the reports used for credit score calculation may be flawed. Unbeknownst to you, your records may include late payments or charge-offs that never happened. When FICO totals are affected by errors, a credit repair company can help.

The law allows every US citizen to correct such errors for free. This is a challenge, as you need to write formal letters to lenders and bureaus. The process requires a thorough analysis of all three reports (from Experian, Equifax, and TransUnion), collection of evidence, and disputing. If there are multiple errors or more proof is required, the repair is drawn-out and frustrating. It is much easier to delegate the job to professionals.

Credit Pros is included in our rating of firms with the best credit repair services. This company is younger than the biggest names like Lexington Law, but its services are highly competitive. It will collect your records, find damaging entries and have them removed on your behalf. In this Credit Pros review, we have analyzed the packages, pricing, rating, and reputation.

What Is The Credit Pros?

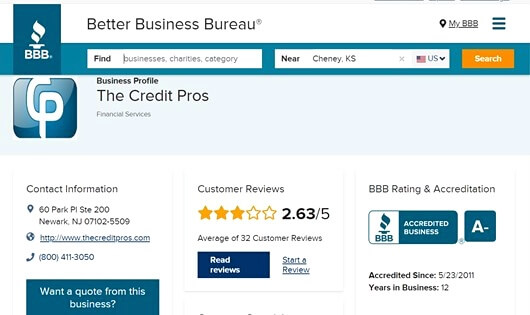

Like other repair firms, the Credit Pros helps customers improve their FICO scores. Founded in 2009 by Credit Law Attorney Jason M. Kaplan, it offers both restoration and rebuilding of borrowing history. The company is headquartered in New Jersey (Newark). Today, it has a positive reputation and the Credit Pros BBB rating is high (A-).

First, the firm can remove false negative information like tax liens, repossessions, late payments, etc. It will communicate with lenders and bureaus to collect evidence, dispute the errors and have them deleted. Secondly, you may gain access to a line of credit to build a positive history. In addition, the company has plenty of educational resources and digital products for better financial management.

The first consultation is always free, and three service bundles cover all typical needs. In addition to cleaning their records, customers can learn to manage their finances wisely. The monthly fees are average for the industry ($69-$149). Even the basic package includes budgeting aids and score tracking, which is a major advantage.

Pros vs Cons of the Credit Pros

The company is accredited by BBB, and its rating is among the highest in the sector (A-). The Credit Pros reviews in 2021 praise the team for professionalism and mention actual score increases. You can make an appointment online and get a free initial consultation. While the level of support is average, the firm has a live chat, unlike many rivals.

All packages, including the cheapest one, come with monitoring. They also include features for personal financial planning. The Credit Pros monthly fee corresponds to the average range.

However, the cheapest bundle only allows you to repair a single false entry. This is uncommon, as most rivals offer at least five disputes to their first-tier customers. Others (e.g., Sky Blue) do not limit disputes at all. In addition, you cannot access support 24/7, which is not a deciding factor.

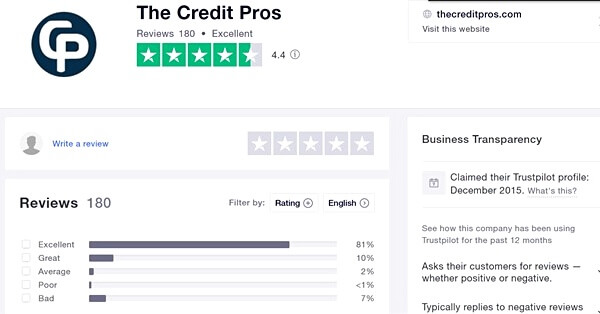

Other concerns are related to the Credit Pros client reviews. Despite the excellent BBB rating, the average total is 2.63/5. In the past 3 years, the Better Business Bureau has registered 46 complaints about the services, collection, and billing. Some comments mention email and text spam. Still, most of the issues are common for the sector. On TrustPilot, the Credit Pros reviews give a higher average — 4.4/5. The company responds to comments actively and takes measures to resolve the problems.

How Does the Credit Pros Work?

During the free consultation, a certified FICO expert reviews your case and suggests the best strategy. Note that only false items may be removed. If the entries are true, you may borrow from the company’s partner to start rebuilding your records.

It takes just 90 seconds to sign up. The firm identifies the most damaging entries and provides education, so you can understand the logic of repair. You will learn about the applicable consumer rights and score calculation. Every customer has 24/7 access to the portal on the site and app. The company’s network of professionals helps with legal action.

The company will repair one or multiple items. In the Prosperity Package and Success Package, disputes are unlimited. The company will remove judgments and other errors. This is done by means of:

- dispute letters;

- debt validation letters (to confirm the amount owed);

- goodwill letters (e.g., asking lenders to delete late payments resulting from debt consolidation);

- cease and desist letters (to stop phone calls).

To deal with accurate negative items, the company offers two methods. The first system (Snowball) is based on the premise that the smallest debts must be paid off first. Then, you move on to deal with larger debts, until the biggest one is paid off. In the Avalanche method, priority is given to your interest expenses: you start with the highest rate.

The Credit Pros Pricing

The company offers three tiers of services covering all typical needs. The Credit Pros cost is average for the industry. However, the cheapest plan will only let you remove a single report entry.

Many competitors allow as many as five different disputes at the entry level. On the upside, monitoring, finance management features, and customer service are included in all plans by default. This helps clients develop better habits, so their history stays positive in the future.

Money Management ($119 upfront + $49 monthly)

The firm will delete one false negative entry. Clients may not only repair but also rebuild their history via lending from National Credit Direct. Meanwhile, tracking and digital aids help improve personal budgeting. You may also take advantage of the company’s legal network. Overall, this package suits the least complex cases — customers who simply want to build a positive borrowing record.

Prosperity Package ($119 upfront + $119 monthly)

This plan increases the number of disputes from one to infinity. It targets customers with multiple false entries who do not want to take out new loans. The setup fee and monthly fee are identical, and all the entry-level services are also included.

Success Package ($149 upfront + $149 monthly)

The most expensive of all the Credit Pros plans combines all second-level services with borrowing options. It caters to customers who need complex repair and rebuilding at the same time.

Alternatives to the Credit Pros

What makes the firm special is monitoring and digital instruments for all customers. They may also borrow through the firm. However, the cheapest plan is very limited. Here is how this fixer compares to rivals.

Lexington Law

Established in 2003, this firm is one of the oldest providers. In recent years, its reputation has been damaged by legal action. Its customer ratings have also been poor. Lexington Law has high monthly rates, although no upfront fees are charged.

Credit Saint

This competitor will also give a refund if it fails to remove a single entry from your report. On the downside, its fees are relatively high. Disputes are unlimited in the premium package only.

Sky Blue

The rival has only one universal package of services, and there are no paid add-ons. Moreover, the price is very competitive, and the refund policy is unconditional. However, you cannot track the progress online, and the first consultation is paid.

| The Credit Pros | Lexington Law | Credit Saint | Sky Blue | |

| Year of establishment | 2009 | 2004 | 2004 | 1989 |

| Services | repair, monitoring, credit line, education | repair, tracking, financial planning, identity theft protection | repair, tracking | repair |

| Monthly cost | $49-$149 | $89.95-$129.95 | $79.99-$119.99 | $79 |

| Upfront fee | $119-$149 | none | $99-$195 | $79 |

| Support | phone, email, app | phone, email, app | phone, email, chat, portal | phone, email, portal |

FAQ

Conclusion

The Credit Pros legal credit repair is best for customers in need of diverse services. Its pricing is relatively high, and the setup fees are substantial. This makes its packages redundant for the simplest cases. However, if you need the full package (tracking, identity monitoring, debt management plans, budgeting help, and more), it is worth the money.